2018/2019 Market Trends: Annual Stats & a Look at the Year Ahead

We are thrilled to share a review of 2018 market activity in the Puget Sound presented by Realogics Sotheby's International Realty. Our acclaimed Research Editor and Data Analyst, William Hillis, has assembled an excellent year-over-year review of eight key counties in Western Washington along with data for 31 communities. In addition to providing in-depth market analysis, this year's report includes a review of 2018 trends: changes in downtown Seattle, interest rates, rising home prices and the S&P CoreLogic Case-Shiller Home Price Index; in addition to a forecast for 2019. We offer the following key highlights from the reports, with a selection of trends to watch, as a conversation starter so we may discuss the impact on homes in your neighborhood.

King County

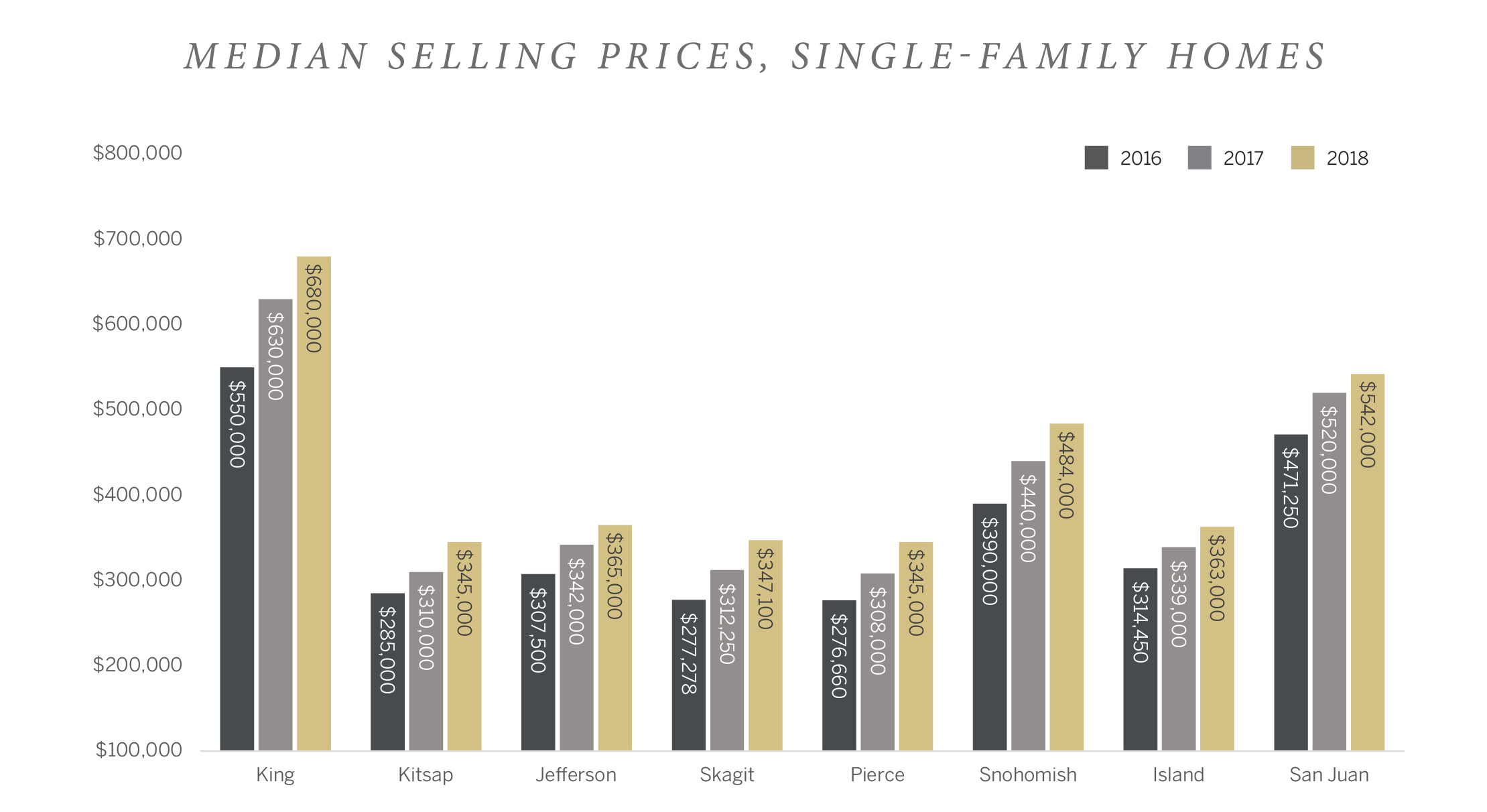

The number of residential selling transactions gradually started to decline in the third and fourth quarters of 2018. The year ended with 11.2 percent fewer home sales than in 2017. For a second consecutive year, both in number and proportion of overall sales, fewer King County condominium units were sold in 2018 (6,885 units, compared with 7,898 in 2017).After steadily shorter market times since 2015, the median cumulative days on market in the fourth quarter of 2018 shot to 26 days—a 16-day year-over-year increase—breaking through the 24-day market time last seen in the fourth quarter of 2014.Of King County cities with more than 500 residential sales in 2018, those with the highest average (not median) selling prices were, in order to average price: Bellevue, Kirkland, Sammamish, Redmond, and Woodinville. The 2018 median residential price was $680,000 and the compound annual growth rate from 2014 through 2018 was 11.5 percent.

Snohomish County

In the third and fourth quarters of 2018, respectively, Snohomish County residential transactions fell by 0.8 and 0.9 percentage points less than King County sales. For the year, Snohomish County saw 10.0 percent fewer home sales in 2018 than in 2017.Since 2014, condominium sales have annually comprised 18 to 19 percent of all home sales in Snohomish County. Their proportion in 2018 was 18.9 percent.Just as in King County, Snohomish County median cumulative days on market expanded to 26 in the fourth quarter of 2018. However, this duration did not exceed that of the fourth quarter of 2015 or any preceding quarter in recent years.Of Snohomish County cities with more than 500 residential sales in 2018, the highest average selling prices were, in order of average price: Edmonds, Bothell, Snohomish, Lynnwood, and Lake Stevens.The 2018 median residential price was $484,000 with a compound annual growth rate of 10.5 percent from 2014 through 2018.

2019 Look Ahead

Risk Aversion Channels Global Wealth Toward Safe Havens

Although the December 1st, 2018 arrest of Huawei CFO Meng Wanzhou was carried out by Canadian authorities at the behest of the U.S. State Department and NSA officials, it came amid seething anti-Chinese resentment in Canada, combined with allegations of money laundering and corruption. Furthermore, Meng's arrest was followed by a series of detentions of Canadian citizens in China, including one death sentence handed down for drug smuggling. In mid-January, China and Canada each issued warnings to the other. U.S.-China tensions aside, the pressure in Canada is greater, particularly considering the relative size of the three economies—the U.S. population is more than nine times that of Canada, and GDP is eleven times as great.Given the threats in Canada of additional taxes or regulation targeting foreign buyers or absentee owners, as well as tit-for-tat arrests of foreign nationals, Seattle and competing U.S. gateway cities can expect to see more of those buyers who in preceding years might otherwise have been lured to Canadian destinations. The same can be said of foreign buyers in Australia and New Zealand, the latter of which in August 2018 announced a complete ban on purchases of domestic real estate by foreigners. In October, the state of Western Australia followed British Columbia, Canada's lead by raising their foreign buyers' surcharge from four percent to seven percent. Uncertainty and civil unrest in the U.K. and Europe have likewise diminished those countries as magnets for real estate investment from Asia and elsewhere.

Rental Headwinds

As a record number of apartments get delivered and start leasing up, there is now a supply glut of rental units in the city. Landlords are offering six to eight weeks of concessions on 12-month leases, making renting more attractive. Stories have also emerged of landlords offering extraordinary concessions, such as gift cards and free parking. Realogics Sotheby's International Realty had previously seen the thousands of tenants incubating in these towers as being prime targets for condo pre-sales; but if these trends persist, they may stay put if the apartments look more attractive and interest rates rise. Of course, the opportunity cost of renting is missing a chance to buy a home before prices rise further.

A Balancing Market

A prime consideration that in recent years has driven so many investment dollars into apartment construction has been the Washington State Condominium Act, which imposes heavy liability for construction defects on builders. A bill before the Legislature this year, the Condo Liability Reform bill (SB 5334), offers a chance to reduce the risk to builders by redefining warrantable defects and by limiting the personal liability borne by condo association board members. Combined with the oversupply of apartments, enactment of the bill could shift more development funds into condominium projects. The bill passed the Washington State Senate on February 25th, 2019.In King County generally, home selling prices were still higher than in 2017; and although active inventory exceeded 2012 levels from September through November, December saw some moderation. Downtown Seattle saw 468 resale closings in 2018, with a median home price of $675,000 and 39 days on market. That compares to slightly higher resales in 2017 (513), with a median home price of $625,000 and 21 days on the market. Downtown Seattle is a thin market and more difficult to discern, yet it seems more sellers are feeling optimistic unloading investment properties due to rental competition, and others are buying into new towers. As the new product comes around and (units) are opened for occupancy, the last-generation products will hit resales.

For more, read the digital publication below or contact us today for a complimentary print copy.